Here's The Typical Process For A Chargeback Dispute With Citibank (Take A Look)

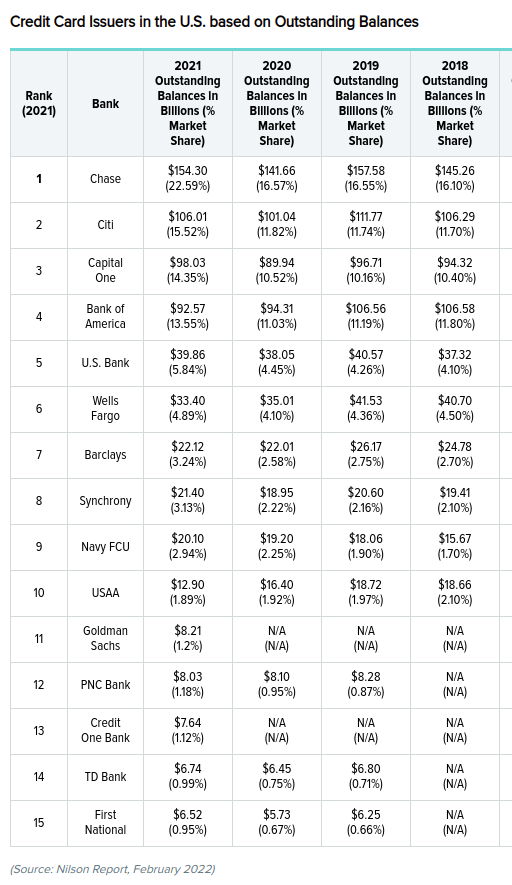

Processing chargeback disputes is a routine activity for Citibank. In 2019, Citi was reportedly the 2nd-ranked credit card issuer in the U.S. based on Outstanding Balances, and 8th-ranked based on purchase volume. So, they handle tons of this disputes every year. (Actually, this article has been updated with more recent data since it was first published in 2019, and Citi was still ranked 2nd as of 2021.)

Yet the details of exactly what Citi's dispute-handling process entails are strangely hard to come by.

👉 So, in this article, I'll give you quick, step-by-step overview of what Citibank's typical process is once you file a chargeback dispute.

Step 1 - confirmation

Although most major banks nowadays give online banking users the option to dispute charges from within the online banking app, for whatever reason, most people still tend to file chargebacks dispute over the phone.

Either way, though, once Citi "accepts" you chargeback dispute--which basically just means that they've agreed to investigate the matter--you will typically receive some sort of written confirmation from Citi of this "acceptance event."

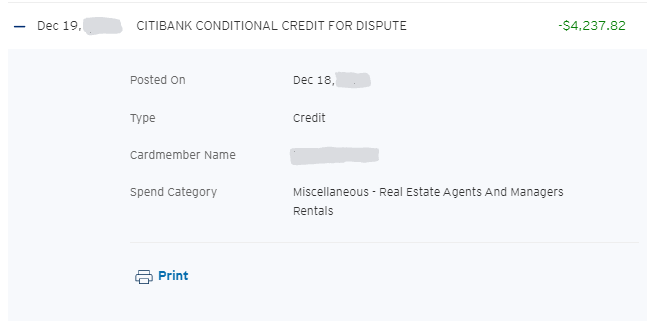

In most cases, you will, at the same time, receive a "conditional credit" for the amount in dispute. Concretely, this means that Citi will put those disputed funds back into your account, right at the outset of Citi's investigation. But the credit is deemed "provisional" to reflect the fact that those funds could be taken back by Citi later if Citi's investigation were to find that the amounts you disputed were not due to you after all.

In effect, then, the record of this "conditional credit" (an example of which is depicted above) can also serve as Citi's written confirmation that Citi has agreed to investigate the transaction(s) you have disputed. The "conditional credit" record will typically include the following four pieces of information:

- Date Posted

- Type

- Cardmember Name

- Spend Category

For each piece of information listed above, you can see example values depicted in the image I have also included above to depict an example of a record of a "conditional credit" from Citibank.

Note also that, once Citi has begun its chargeback dispute investigation, there will usually be some indicator of the dispute appended to the original transaction record.

In the example record depicted above, you see this in the form of the "Dispute In Progress" tag. You will also notice that a "Track Dispute" button appears in the original transaction record, which is intended to make it easier for you to check up on the status or progress of Citi's chargeback dispute investigation: rather than having to pick the phone again to call Citi for an update, for example, you could just click that button from inside your online Citibank account.

Step 2 - notification to merchant

Because Citi's goal in a chargeback dispute investigation is to try to determine if the disputed charge is valid (or not), Citi will usually begin its investigation by notifying the merchant of your dispute--usually, this notification passes through one or more additional entities before it eventually makes it to the merchant, but the notification finds its way to the merchant nonetheless.

By notifying the merchant of your dispute, Citi is essentially asking the merchant to provide evidence showing that the dispute charge is valid, despite your filed claim that the charge is not valid. That way, Citi can give both sides in the dispute a fair hearing.

However, this request is not open-ended. Citi will specify a deadline by which the merchant must respond to the request (usually, this is 30 days or less from the date of Citi's request to the merchant).

💡Pro tip: by asking Citi to tell you what this deadline date is, you can not only have some sense of the overall timeline for the dispute process, but also a sense of the timeline surrounding this key milestone in the dispute process: when/whether the merchant responds to the dispute.

...because, if the merchant chooses to not respond at all, or fails to respond by the deadline, Citi will typically find in your favor, and the overall timeline for the dispute process could be shortened, just because there would be no merchant-submitted evidence for Citi to review before eventually deciding whether the disputed charge was valid or not.

Step 3 - representment

If the merchant responds by the deadline, then representment will follow (this portion of the dispute process is called "representment," because the merchant will typically be submitting evidence to Citi to show, or try to show--or "represent"--that the charge was valid, despite your filed claim to the contrary).

You can think of this as the "he said she said" part of the process, because, by this point, you would have already stated your position to Citibank, and the merchant would have just stated theirs. So, Citi must then decide whose position is more credible or correct.

Step 4 - outcome

Once Citi makes a decision for your dispute, you will typically receive a snail-mail notification stating what happened during Citi's investigation, and what Citi's decision is with regard to your dispute.

The snail-mail notification will usually be a multiple page letter with a return address of:

CITIBANK

CUSTOMER SERVICE

PO Box 6013

Sioux Falls SD 57117-6013

Those letters usually begin with the lines...

Dear [CARDMEMBER NAME]:

This letter concerns the transaction described below made with card number [XXXXXXXXXXXXXXXX]:

[Date Amount Description]

A copy of the merchant's response is enclosed.

Based on the information available, we have closed our investigation and

[Citi's decision and final action following re: your chargeback dispute].

As you can see in the quoted snippet above, the letter will often contain any response the merchant provided to Citi during the investigation. This will typically consist of a summary of the merchant's counter-view, if any, and any evidence the merchant provided to try to support that counter-view.

The letter will also typically include three alternative ways to contact Citi's "Billing Dispute Unit" about your dispute if need be:

- Fax number: 1-866-799-4758

- Email address: billingdispute@citi.com

- Phone number: 1-877-601-8029

If you end up "winning your dispute," you'll typically receive written confirmation in this letter that the "conditional credit" to your account which Citibank had previously issued on only a temporary basis has been made permanent.

That's it. That's the typical Citibank chargeback dispute process.