Consumer Warning Issued To Anyone With Unpaid Tolls

Drivers with past-due toll debt may not be protected from unscrupulous debt collectors under the FDCPA.

The warning came in the form of a court opinion in a case involving debt collection for past-due highway tolls.

In that case, a driver signed up for an E-Z Pass account to manage the tolls he incurred while travelling on certain roads in New Jersey.

As you may already know, that meant that the workflow should have been that...

- The driver incurred the tolls.

- Those tolls would accumulate in his E-Z Pass account.

- E-Z Pass would then issue him a periodic bill for any tolls owed for that period (say, one bill per month, instead of one bill per instance of a new toll being incurred).

- The driver would then be obligated to pay each bill by its stated due date.

This workflow was intended to make payment of tolls easier on drivers, by issuing fewer bills with multiple tolls lumped together, rather than requiring payment each time a new toll was incurred. And it worked: the E-Z Pass workflow made it considerably more efficient for the driver to pay his tolls.

Past-Due E-Z Pass Tolls

The problem arose, however, when the driver fell on hard times, and, as result, was not able to pay his E-Z Pass bill on time.

After some period of time passed without the due payment being made, the driver's past-due E-Z Pass bill was handed over to a debt collection agency, who then contacted the driver by "snail-mail" letter.

Debt Collection Letter

The debt collector's letter was packaged inside an envelope. That envelope included a small, clear window on the envelope's face.

The traditional purpose of such a window is to make the addressee's address visible, as printed on the letter contained inside the envelope. This makes the mail-preparation work necessary to send out these debt collection letters more efficient, since the debt collection agency need only print the address on the letter, and not also on the outside of the envelope.

FDCPA Regulates Collection of Consumer Debt

However, as debt collector's have long known, there are potential legal consequences for using these envelope windows in a way that exposes additional contents of the letter beyond only the addressee's address. For example, if the letter said, "Hey, Joe, you owe us $10,000," and any part of that statement were also visible through the envelope window, then the debt collector who sent that letter could potentially be in violation of the Fair Debt Collection Practices Act (“FDCPA”).

Specifically, courts have held that the FDCPA prohibits debt collectors from including on an envelope containing a collection letter “any language or symbol, other than the debt collector’s address[.]” See 15 U.S.C. § 1692f(8).

New Jersey Driver Sues Debt Collector

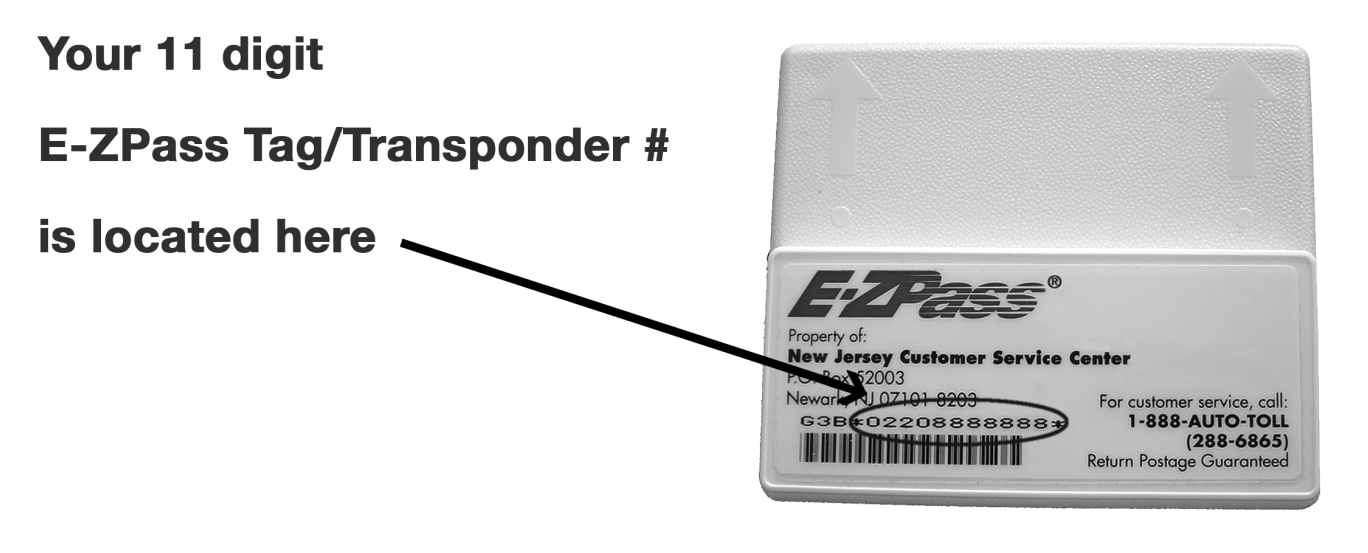

The New Jersey driver recognized this implication when he received the debt collector's letter regarding his past-due E-ZPass bill, because the driver's E-ZPass account number and a so-called “quick response” code was visible through the envelope's window. So, on the basis of 15 U.S.C. § 1692f(8), the driver filed suit against the debt collection agency.

Key Question: Is a "Highway Toll" a "Consumer Debt?"

Because the New Jersey driver filed suit on the basis of 15 U.S.C. § 1692f(8) (i.e. the FDCPA), the court needed to decide whether the FDCPA applied at all. To do that, the court needed to specifically decide whether a so-called highway toll is a "debt" within the meaning of the FDCPA.

In asking the court to answer that question, the stakes for the New Jersey driver's case could not have been higher--because, as you will see, a finding that a highway toll is not a "debt" within the meaning of the FDCPA could result in the New driver's lawsuit being dismissed.

The Court's Analysis

The court began by recognizing that the FDCPA only applies to the collection of a "debt" as defined in the FDCPA itself. So, the FDCPA's definition of the term "debt" was important.

The FDCPA defines "debt" as an...

obligation [...] of a consumer to pay money arising out of a transaction in which the money, property, insurance, or services which are the subject of the transaction are primarily for personal, family, or household purposes.

See 15 U.S.C. § 1692a(5).

The court then reminded the parties that the FDCPA's prohibitions (e.g. against certain kinds of debt collection activities) could only apply to the New Jersey driver's lawsuit if and only if the tolls in question fit the FDCPA's definition of the term "debt."

The district court answered this question in the negative, that the tolls in question did not fit the FDCPA's definition of the term "debt," and, on that basis, the court dismissed the New Jersey driver's lawsuit.

The Plaintiff Appeals

Following the district court's dismissal, the New driver appealed the case to The United States Court of Appeals for the Third Circuit, asking that court to answer the same key question--and, of course, hoping that the appeals court would reach a different result.

The appeals court did not reach a different result, however. Instead, in August 2018, the Third Circuit affirmed the district court's dismissal, explaining their reasoning by describing an established, three-part test courts use to determine whether an obligation is a “debt” under the FDCPA, as follows...